SECTION 1031 EXCHANGES AND THE AUCTION INDUSTRY

In the summer of 2008, I was honored to be asked to author an article for The Auctioneer, the official publication of the National Auctioneers Association, on the subject of Section 1031 exchanges and their application within the auction industry. The article was published in the September 2008 issue. The article is no longer available online, but it is reprinted below:

The purpose of this article is to provide basic information about Section 1031 exchanges and discuss some particular matters that apply to exchanges and the auction industry. Ultimately, the idea is to supply you with another arrow in your quiver to distinguish your company from your competitor who is not familiar with the benefits that Section 1031 exchanges offer.

What is a Section 1031 exchange? Section 1031 of the Internal Revenue Code was made a part of US tax code in the early 1920's, shortly after our modern income tax code came into being through the ratification of the Sixteenth Amendment in 1913. Section 1031 allows the owner of property held for investment or used in a business to dispose of that property through a sale and reinvest the sale proceeds in new property that will be held for investment or used in a business and defer any taxes on capital gains. (A taxpayer can exchange either real estate or business personal property or both.) The net effect of this tax savings is that more money is available for the purchase of the new property; sometimes a lot more money. There are a number of factors that determine the taxes owed on a sale when an exchange is not utilized, but in some cases taxes can represent a very sizable portion of the client's proceeds. In extreme cases, more taxes might be due than proceeds received!

Over the years since Section 1031 was added to the US tax code, the IRS has made many aspects of exchanges much clearer as to what is allowable and what is not. Today, while there are still areas of gray, in most cases a knowledgeable exchange expert can offer a quick assessment of the viability of an exchange in a given situation.

When you are involved in selling property that has been held as an investment or used in a business and your client is considering reinvesting the proceeds in new property, it will demonstrate your concern for your client's best interests if you bring up the possibility of a Section 1031 tax-deferred exchange. You do not need to be an expert in exchanges; you merely need to know an expert whom you can call on for help. Back in 1991, Treasury Regulations established the use of an entity known as a Qualified Intermediary to handle exchanges. Qualified Intermediary companies come in a wide variety of sizes, much like auction companies. Find out who handles exchanges in your area. One way of doing that is to visit the web site of the national association for the industry, the Federation of Exchange Accommodators, at www.1031.org, and use the Member Locator for your area. Many QIs, including my company, work nationwide. Establish a relationship with a QI or two so you can call on them for assistance when one of your clients might benefit from an exchange.

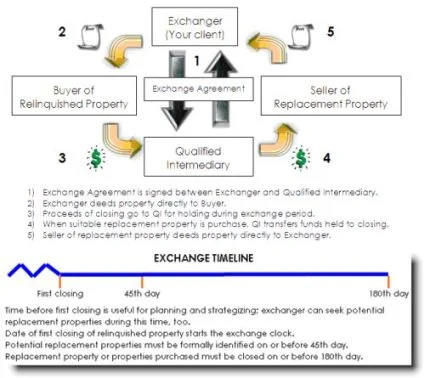

The diagram below illustrates the basic structure and requirements of an exchange.

Specific questions about exchanges and auctions:

When should I get in touch with a QI? The important thing to remember is that exchange documents must be signed and in place before closing and transfer of title occurs. Many QIs can do the paperwork for an exchange in a matter of twenty-four hours or less, but most prefer to be involved earlier in the process. Bringing the QI in early enables him to gain a thorough understanding of the circumstances, and allows plenty of time for review of all documents and the answering of any questions.

Does a 1031 exchange become a contingency in the contract? How does an exchange affect my "as-is, where-is" sale? If you affiliate yourself with a knowledgeable QI, he will thoroughly explain to your client the various rules and regulations that must be adhered to in order to achieve a successful exchange. With a clear understanding of the requirements of Section 1031, the client can decide whether to proceed with or without an exchange. Whether or not the client enters into an exchange agreement with the QI, the sale can take place without contingencies as to the exchange. In essence, the exchange is external to the auction.

Do I need to put "cooperation language" in the contract? Is there any harm in putting that language in the contract? "Cooperation language" refers to disclosing to the other party that one is involved in an exchange. There is no specific requirement to disclose in the contract that an exchange is in process. On the other hand, in an auction setting it does no harm in disclosing the existence of an exchange. Many commercial real estate companies have incorporated cooperation language into their standard purchase contracts today. If cooperation language is not included in the purchase contract, it is important that there be no prohibitions to assigning the purchase contract, because it must be assigned to the Qualified Intermediary for the exchange to proceed. If present, prohibition language in the contract can be overridden by the parties by using an addendum.

We provide the following language to our clients for their purchase agreements: "It is the intention of Seller to transfer the above-listed property pursuant to Internal Revenue Code Section 1031, which sets forth the requirements for tax-deferred real estate exchanges. Seller's rights and obligations under this and future agreements will be assigned to Iowa Equity Exchange, qualified intermediary, for the purpose of completing an exchange. Buyer of the above-listed property agrees to cooperate with Seller and Iowa Equity Exchange in a manner necessary to enable Seller to complete said exchange. Such cooperation shall be at no additional cost or liability to Buyer."

Should I add "1031 Exchanges Welcome" to my advertisements, or something similar? It certainly cannot hurt anything, and it demonstrates your awareness of the process.

As an agent of the seller, can I promote to the seller the use of a particular exchange agent? There are many opportunities for the auction company to refer business to any number of service providers. Termite inspections, title companies, attorneys, accountants, and more are part of the typical real estate transaction. If you refer business to those sorts of companies, you should feel comfortable establishing a relationship with an exchange company for referrals to them as well.

What is the difference between the exchange agent and the closing company? Can they be the same company or must they be different? The exchange company oversees the closing to ensure that it complies with the requirements of Section 1031. The closing company actually conducts the closing and cooperates with the exchange company to meet those requirements. Restrictions within Section 1031 prevent certain parties who are agents of the taxpayer from functioning as their Qualified Intermediary. This includes relatives, the exchanger's attorney, accountant, employee, investment banker or real estate broker or agent. The code specifically excludes a title company from the list of disqualified parties. Often, title companies that also function as Qualified Intermediaries operate their exchange business under a different name. If you consider having your clients use a closing company as an intermediary, before you refer business to them you should be satisfied that they are knowledgeable about the intricacies of Section 1031 requirements. Working with a full-time exchange specialist generally is a safer course than employing a closing company that tries to accommodate exchanges on a part-time basis.

Why do I care which exchange agent my client uses? If all exchange companies were the same, it would not matter which one your client used. If you deal with more than one exchange company, you will find over time that one is easier to deal with than the others. One will have more knowledge about exchanges. The people at one company will go out of their way to assist you and your auction client. In addition to knowledge and service, you and your client also need to consider the security of your client's funds. Some QIs promote a bond that they have purchased. Others believe that a dual-signature account requiring the exchanger's approval plus the directions of the QI to move money is a safer solution. Discuss security of funds with your QI so that you know what actions are being taken to protect your client's money.

“a reverse exchange can allow you to accept a winning bid from someone who needs to sell another property to buy the one you are auctioning”

Is there a way an exchange can assist prospective buyers? If you often work with prospective buyers prior to a sale, you should familiarize yourself with reverse exchanges. If you hear a prospect say something like, "I wish I could bid on that piece of ground, but I'd need to sell this piece to buy it," you should think of a reverse exchange. The term "reverse exchange" is a misnomer, because technically nothing is done in reverse order. In a reverse exchange, the exchanger directs a new entity, such as a single-purpose LLC, (typically formed by the QI) to purchase a property and hold title to it while the exchanger sells one or more properties as the first leg of the exchange. Once those properties sell, the QI arranges a standard exchange between the new entity and the exchanger. The advantage to you in an auction setting is that a reverse exchange can allow you to accept a winning bid from someone who needs to sell another property to buy the one you are auctioning.

In conclusion, Section 1031 exchanges can be a boost to your auction business and a service to your clients. The basic structure and rules are straightforward and easy to understand. Idiosyncrasies within nearly every exchange make the involvement of a knowledgeable exchange expert imperative. Awareness of the basics by the auctioneer and the assistance of a respected exchange professional can help set your business apart from the crowd.

The foregoing information is a basic overview of Section 1031 tax-deferred exchanges. In no way does it substitute for tax or legal advice in a particular situation. Please consult your tax and legal advisors before beginning an exchange. Ken Tharp is the owner of Iowa Equity Exchange, a Qualified Intermediary service located in West Des Moines, Iowa. He has been a real estate investor in central Iowa for thirty years. His background includes construction, property management, sales, property rehabilitation and development. Iowa Equity Exchange handles all types of exchanges: delayed, improvement, construction, and reverse structures. For more information about exchanges, go to www.iowaequityexchange.com or contact Ken by phone (515-224-5259 office) or by email at ktharp@iowaequityexchange.com.

© IOWA EQUITY EXCHANGE